Artificial Intelligence and machine learning in digital finance

December 28, 2023

Table of contents

Quick Access

Artificial intelligence is dominating all areas of technology today, that includes digital finance and online banking. Users have preferred to carry out all their banking movements and transactions from the comfort of their personal computer or cell phone, so it is logical that these processes be renewed and updated to the trends of the moment.

In addition to artificial intelligence, machine learning is also being applied in online financial processes. “Machine learning is a branch of artificial intelligence (AI) and computer science that focuses on using data and algorithms to mimic the way humans learn, gradually improving their accuracy” according to IBM.

Uses of machine learning in digital finance

Machine learning, a direct branch of artificial intelligence, can be used in various ways within online banking and Fintech. Among the most popular are:

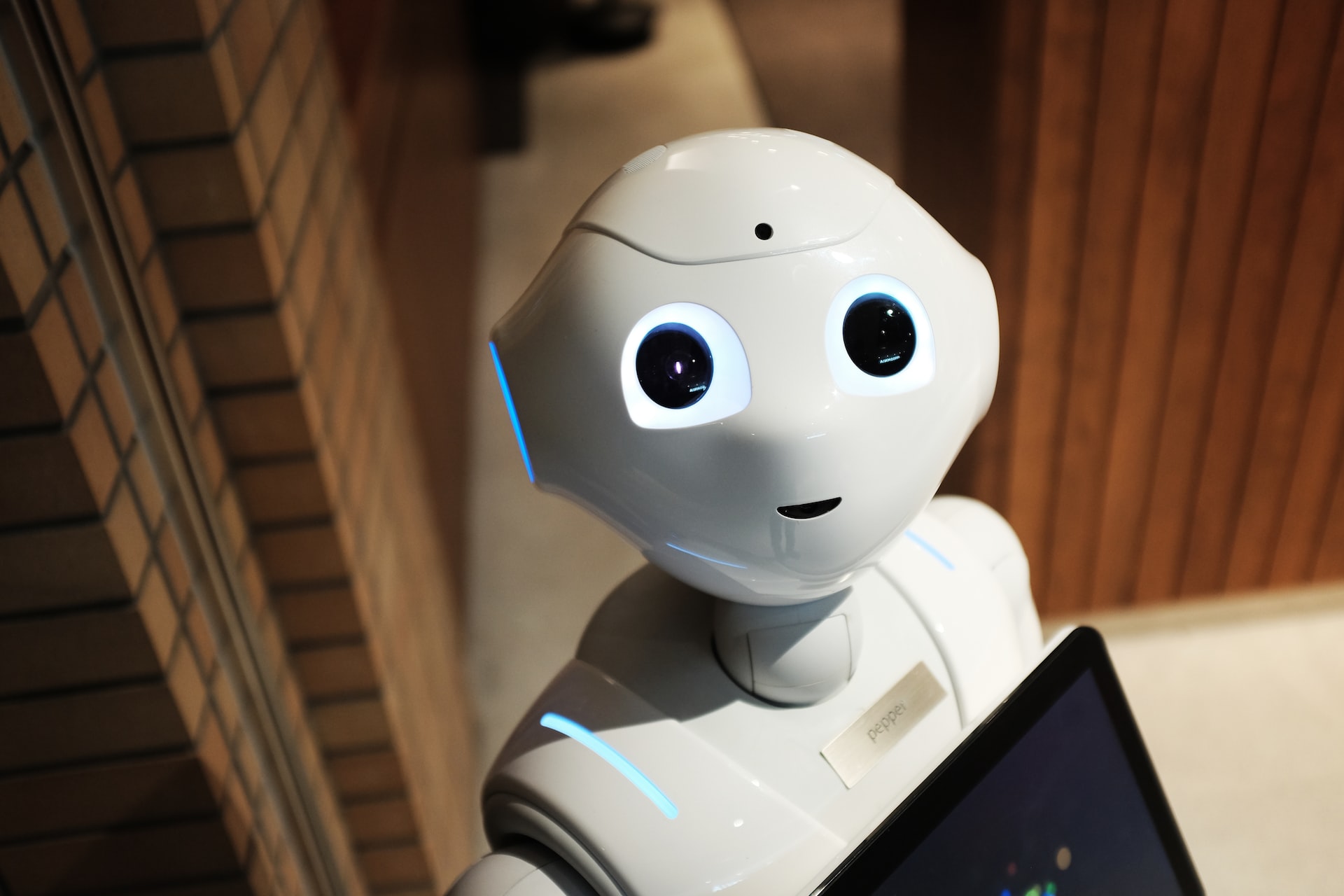

Chatbots

In simple words: a chatbot is a computer program that simulates a conversation with another human, with which it helps solve various user problems before deciding whether they should have interaction with customer service.

Credit score

Machine learning algorithms analyze a wide range of data to assess creditworthiness more accurately than traditional credit scoring models. This includes not only historical financial data but also non-traditional data sources, such as social media activity and online behavior.

Fraud detection

ML is used to detect unusual patterns or anomalies in transaction data that may indicate fraudulent activity. By learning from historical fraud cases, algorithms can adapt and continually improve their ability to identify new and sophisticated fraud patterns.

Algorithmic trading

Machine learning algorithms analyze historical market data to identify patterns and trends, helping traders make more informed investment decisions. Some trading algorithms also use reinforcement learning to adapt and optimize strategies over time.

Normative compliance

Machine learning algorithms help financial institutions meet regulatory requirements by automating transaction tracking and reporting. This helps identify and prevent fraudulent or illicit activities.

Predictive analytics for loans

Machine learning models analyze historical data to predict the likelihood of loan defaults, helping lenders make more informed decisions when approving or rejecting loan applications. This improves the accuracy of risk assessments.

Market analysis

Machine learning techniques are used to analyze news articles, social media, and other information sources to measure market sentiment. This information can be valuable in making investment decisions and understanding market dynamics.

Cybersecurity

Machine learning algorithms improve cybersecurity by detecting and preventing cyber threats, including phishing attacks and other forms of online fraud. They can learn from historical data to identify new and evolving security threats.

The application of machine learning in digital finance continues to evolve, offering innovative solutions to traditional financial challenges and improving the overall efficiency and effectiveness of financial services.

At Rootstack, we have a team with knowledge and skills in machine learning projects to apply it in your company. Contact us and let's start working together.

We recommend you on video

Related Blogs

How to integrate UiPath RPA with a database

Magento Development Services for the Healthcare Industry

Best Practices for Hiring a Drupal Developer

5 steps of UiPath RPA implementation